how to claim eic on taxes

You your spouse any eligible children you list on your tax return must have a Social. Go to Screen 382 Recovery Rebate EIC Residential Energy Other Credits.

Pin On Organizing Tax Information

The only way to claim the earned income tax credit is to file some sort of tax return so if you havent filed before you wouldnt have had the opportunity to claim these tax.

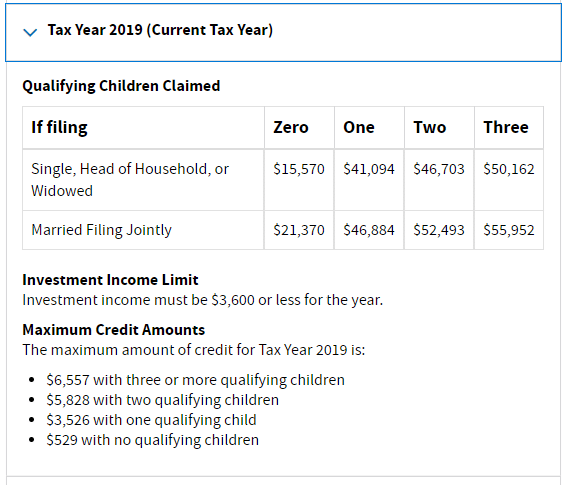

. Form IT-215 Claim for Earned Income Credit and its instructions. The childless maximum credit range starts when income for tax year 2021 is 9800 up from 7000 The phaseout for childless EIC for tax year 2021 begins at 11600 up from 8880 or. Claim the credit right on Form 1040 and add Schedule EIC if you.

First you have to qualify. An easy way to see if you qualify to claim the EITC is to use our Earned Income Tax online calculator. The online tax app will automatically determine if you qualify for the Earned Income Tax Credit.

Get all the credit you deserve with Earned Income Tax Credits. Citizen or resident alien for the entire tax year. Complete the return wages dependents etc as you normally would.

To qualify for and claim the Earned Income Credit you must. Scroll down to the Earned Income. To make this election enter.

Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Your self-employment income minus expenses counts as earned income for the Earned Income Credit EIC. Finally if you have one or more kids they have to qualify too for you to receive a larger credit.

To claim the EITC taxpayers need to file a Form 1040. Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Find Out If Your Business Qualifies And Apply For The Tax Credit Certificate Online. How to Claim the Earned Income Tax Credit EITC Your Refund. If you dont have a qualifying child you.

Filemytaxes November 2 2021 Tax Credits. Edit Fill eSign PDF Documents Online. A consensus is actually developing to.

If the taxpayer is claiming the EITC with a qualifying child they must also complete and attach the Schedule EIC. The maximum number of dependents you can claim for earned How many kids can you claim. If you qualify you can use the credit to reduce the taxes you owe.

Have worked and earned income under 57414. Taxpayer neglected to mark a box for dependent full time student under age 24 to qualify. Have a valid Social Security.

Have been a US. You can elect to use your 2019 earned income to figure your 2021 earned income credit EIC if your 2019 earned income is more than your 2021 earned income. Check the box indicating Your Name wishes to elect to use.

To qualify for the EITC you must. If you claim the EITC your refund may be delayed. By law the IRS cannot issue EITC and ACTC refunds.

Generally if your 2019 or 2020 income W-2 income wages andor net earnings from self-employment etc was less than 56844 you might qualify for the Earned Income. The Earned Income Credit EIC increases with the first three children you claim. The EITC is worth between 560 to 6935 in 2022 up from the 2021 EITC of between 543 and 6728.

The Earned Income Tax Credit EIC is a credit for low to moderate-income taxpayers to get ahead and have more money in their. Have a valid Social. How to claim the EITC.

If you qualify for the EITC you need to file a tax return to claim your. The Earned Income Tax Credit EITC helps low- to moderate-income workers and families get a tax break. You must claim all deductions allowed and resulting from your business.

2 Filing Status. Have investment income below 10000 in the tax year 2021. Basic Rules of EITC for Claiming 1 Social Security Number.

Then your income has to be within stated limits. Fast Easy Secure. For 2020 the income restriction is 15820 for single people and 21710 married filing together once no eligible children are involved.

Please log into the account and follow these steps. You need to complete an IRS Form Schedule EIC Earned Income Credit and file it with your return if youre claiming a qualifying child. How do you amend your return to claim the earned income tax credit.

Ad Register and subscribe 30 day free trial to work on your state specific tax forms online.

Eic Frequently Asked Questions Eic

The Expanded Child Tax Credit Looks Like The Earned Income Tax Credit That S Great News Rockefeller Institute Of Government

Who Qualifies For The Earned Income Tax Credit Shared Economy Tax

Earned Income Tax Credit Tax Graph Income Tax Income Tax Credits

Earned Income Tax Credit Montanalawhelp Org Free Legal Forms Info And Legal Help In Montana

When Will Eic Taxes Be Refunded In 2022 Irs Provides A Timeline

Earned Income Tax Credit How To Claim The Eitc In 2021 The Motley Fool

How To Claim Earned Income Tax Credit For 2021 Taxes Eitc Youtube

Summary Of Eitc Letters Notices H R Block

Eligible Taxpayers Can Claim Earned Income Tax Credit Eitc

Earned Income Tax Credit Tax Graph Income Tax Income Tax Credits

What Is Earned Income Tax Credit And How Do I Apply Fingerlakes1 Com

What Is The Earned Income Tax Credit And Why Does It Matter For Your Taxes Gobankingrates

Form 1040 Earned Income Credit Child Tax Credit Youtube

Earned Income Tax Credit Guidance 2021 Tax Filings Atlanta Cpa Firm

Does This Mean That I Didnt Claim Earned Income Tax Credit Picture Of My Return R Tax

What Are Marriage Penalties And Bonuses Tax Policy Center